The Modern Personal Finance Stack

Heads up: This post is outdated and/or represents a previous opinion of mine that has since changed. Please enjoy a look into the past, but don't link to it or reference it externally. Thanks!

Looking for my current writing? You can find that here.

Disclaimer: All content provided on this site is for informational purposes only and does not constitute professional financial or security advice.

Intro

Your “Personal Finance Stack” is the collection of tools, banking partners, and investing services you’ve chosen to manage your assets and financial life.

A sample personal finance stack might look something like this:

- Checking and Savings Accounts: Bank of America

- Brokerage/Investing Accounts: Merrill Lynch

- Retirement Accounts: Fidelity

- Credit Cards: Citi and American Express

- Asset Tracking and Budget Planning: Mint

- Identity Protection and Credit Score Monitoring: LifeLock

- Financial Advisory Services: Merrill Lynch

Nothing too crazy, right? Not so fast.

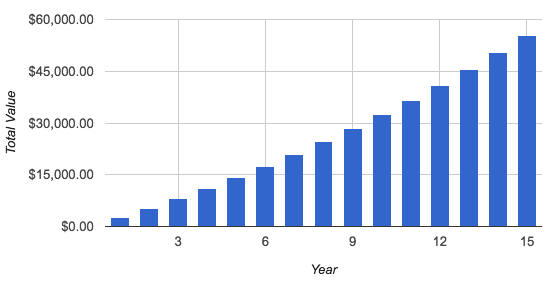

The average outdated personal finance stack can cost over $2,577/year in opportunity cost and unnecessary fees.

Assuming 5% annual returns, that amounts to roughly $55,500 over 15 years.

In this post, I’ll break down the above assertion and examine the dangers associated with the ongoing use of an outdated personal finance stack. In closing, I’ll propose a modern personal finance stack, updated for 2016.

Assumptions and Simplifications

The following analysis and recommendations are designed to be valid regardless of income level, net worth, marital/joint account status, and other factors that affect general personal finance decisions.

With that said, my analysis assumes the following conservative financial profile for simplicity in modeling opportunity cost and fees.

- $5,000 daily balance in primary checking account

- $15,000 daily balance in primary savings account

- $50,000 in taxable investment assets

- $50,000 in tax-deferred retirement assets

- A 750 credit score

- $3,000 in monthly credit card spending with no monthly balance carry

A critique of the outdated personal finance stack

Above: An example of an outdated personal finance stack.

An outdated personal finance stack is typified by:

- Sub-par interest rates for both checking and savings accounts.

- High transaction fees/expense ratios associated with brokerage accounts and mutual funds.

- High advisory fees charged by financial advisory services.

- Recurring fees for credit monitoring, identity protection, and financial account security services.

As I detail below, these attributes compound to cost over $2,577 per year in fees and opportunity costs.

The annual fees of an outdated personal finance stack

| Account Type | Outdated Stack Selection | Outdated Stack Annual Cost (description) | Outdated Stack Annual Cost ($) |

|---|---|---|---|

| Checking | Bank of America | No maintenance fee with a daily balance above $1,500 | $0.00 |

| Savings | Bank of America | No maintenance fee with a monthly balance above $300 | $0.00 |

| Brokerage/Investing | Merrill Lynch | Average Expense Ratio of 0.68% (x $50,000) | $340.00 |

| Retirement | Fidelity | Average Expense Ratio of 0.6% (x $50,000) | $300.00 |

| Credit Card | Citi Simplicity and AmEx Premier Rewards Gold | Annual fees of $0 and $195, respectively | $195.00 |

| Identity/Credit Monitoring | LifeLock | $220, when paid annually | $220.00 |

| Financial Advisory Services | Merrill Lynch | Annual Management Fee of 1.3% (x $100,000) | $1,300.00 |

Total cost of annual fees: $2,355.00

Annual Interest and Cash Back of the Outdated Personal Finance Stack:

| Account Type | Outdated Stack Selection | Outdated Stack Interest/Cash Back ($) |

|---|---|---|

| Checking | Bank of America | $0.50 |

| Savings | Bank of America | $1.50 |

| Credit Card | Citi Simplicity and AmEx Premier Rewards Gold | $216.00 |

Total returns from interest and cash back rewards: $218

Using our conservative financial profile with roughly $120,000 in total assets, fees + interest/cash back benefits combine to total a net loss of $2,137 per year.

A proposal for the most efficient modern personal finance stack

The Modern Personal Finance Stack

(None of the below links are affiliate / referral links)

- Checking Account: Capital One 360

- Savings Account: Ally Bank

- Investing / Brokerage: Vanguard

- Credit Cards: Chase Sapphire Preferred and Chase Freedom

- Credit Score Monitoring: Credit Karma

- Asset Tracking and Retirement Planning: Personal Capital

- Identity Protection and Account Security: Credit report freezes, 1Password, and enabling Two-Factor Authentication

This modern personal finance stack is optimized towards the following objectives:

- Avoiding “At rest” fees (maintenance fees, inactivity fees, etc.).

- Avoiding “Money movement” fees (checks printing fees, ATM withdrawal fees, foreign transaction fees, wire transfer fees, etc.).

- Optimizing for the highest possible interest rates possible on personal checking and savings accounts.

- Optimizing for the lowest possible investing expense ratios for mutual funds emulating the performance of the S&P 500.

- Optimizing for the strictest identity protection and account security practices available.

Annual Costs of the Modern Personal Finance Stack:

Using the same financial profile we used to evaluate the costs of an outdated personal finance stack, we’ll examine the annual costs of the modern personal finance stack.

| Account Type | Modern Stack Selection | Modern Stack Annual Cost (description) | Modern Stack Annual Cost ($) |

|---|---|---|---|

| Checking | Capital One 360 | No maintenance fees | $0.00 |

| Savings | Ally Bank | No maintenance fees | $0.00 |

| Brokerage/Investing | Vanguard | Average Expense Ratio of 0.18% (x $50,000) | $90.00 |

| Retirement | Vanguard | Average Expense Ratio of 0.18% (x $50,000) | $90.00 |

| Credit Card | Chase Freedom and Chase Sapphire Preferred | Annual fees of $0 and $95, respectively | $95.00 |

| Identity/Credit Monitoring | Credit Karma and Credit Report Freezes | $45 one-time credit report freeze fee | $45.00 |

| Financial Advisory Services | Self-Directed | N/A | $0.00 |

Total cost of annual fees: $320

Annual Interest and Cash Back of the Modern Personal Finance Stack:

| Account Type | Modern Stack Selection | Modern Stack Interest/Cash Back ($) |

|---|---|---|

| Checking | Capital One 360 | $10.00 |

| Savings | Ally Bank | $150.75 |

| Credit Card | Chase Freedom and Chase Sapphire Preferred | $600.00 |

Total returns from interest and cash back rewards: $760.75

Using our conservative financial profile with roughly $120,000 in total assets, fees + interest/cash back benefits combine to total a net gain of $440.75 per year.

Outdated v.s. Modern Personal Finance Stack

| Total Annual Fees | Total Annual Benefits | Net Annual Cost | |

|---|---|---|---|

| Outdated Personal Finance Stack | $2,355.00 | $218 | $2,137 |

| Modern Personal Finance Stack | $320.00 | $760.75 | -$440.75 |

Appendix

If this post has inspired you to update some components of your personal finance stack, links to my recommendations are below.

None of the below links are affiliate / referral links, but it’s always a good idea to do a quick Google search for [account name] signup bonus to double check if there are any deals to be had when opening a new account.

Recommendations:

- Checking Account: Capital One 360

- Savings Account: Ally Bank

- Investing / Brokerage: Vanguard

- Credit Cards: Chase Sapphire Preferred and Chase Freedom

- Credit Score Monitoring: Credit Karma

- Asset Tracking and Retirement Planning: Personal Capital

- Identity Protection and Account Security: Credit report freezes, 1Password, and enabling Two-Factor Authentication